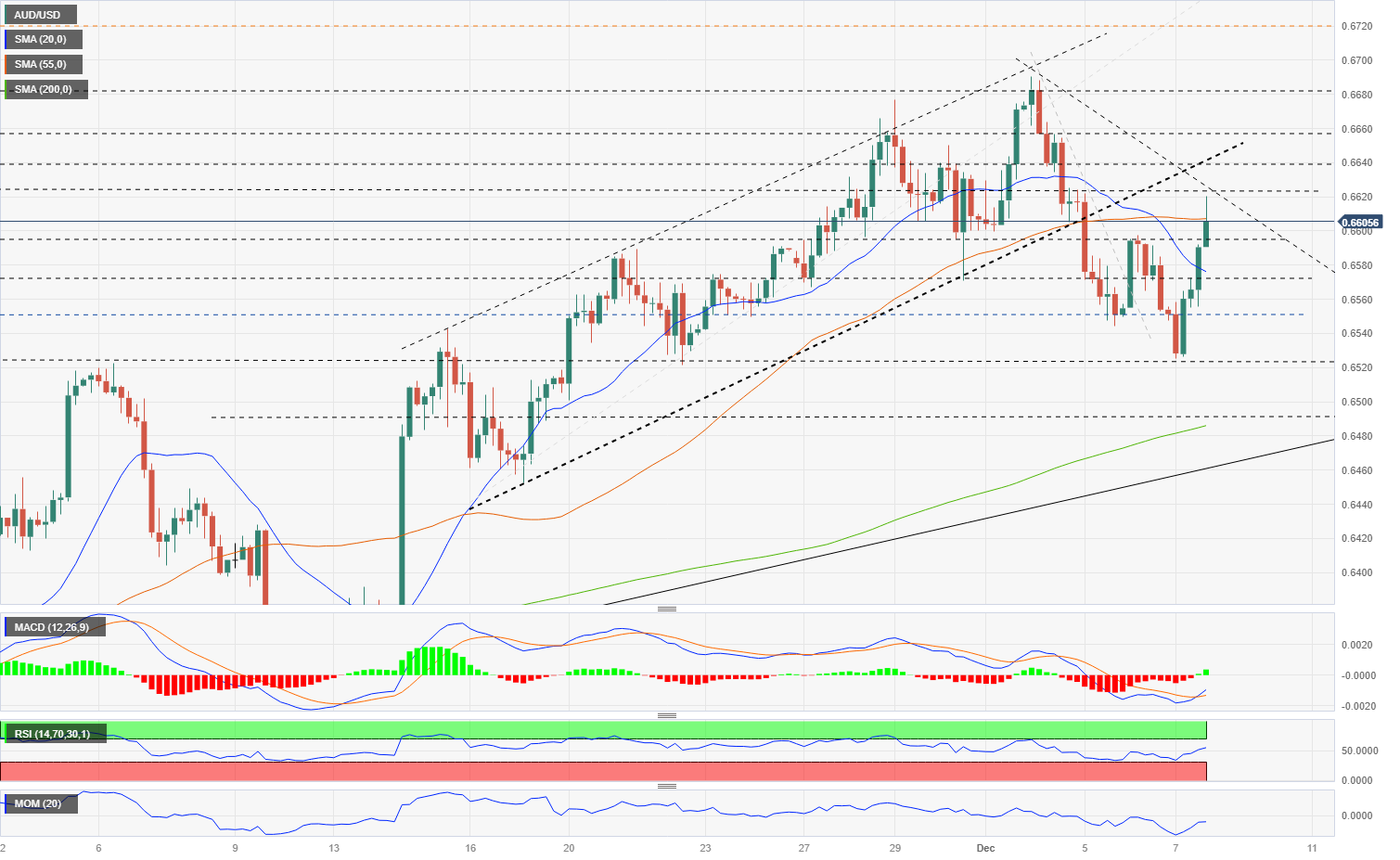

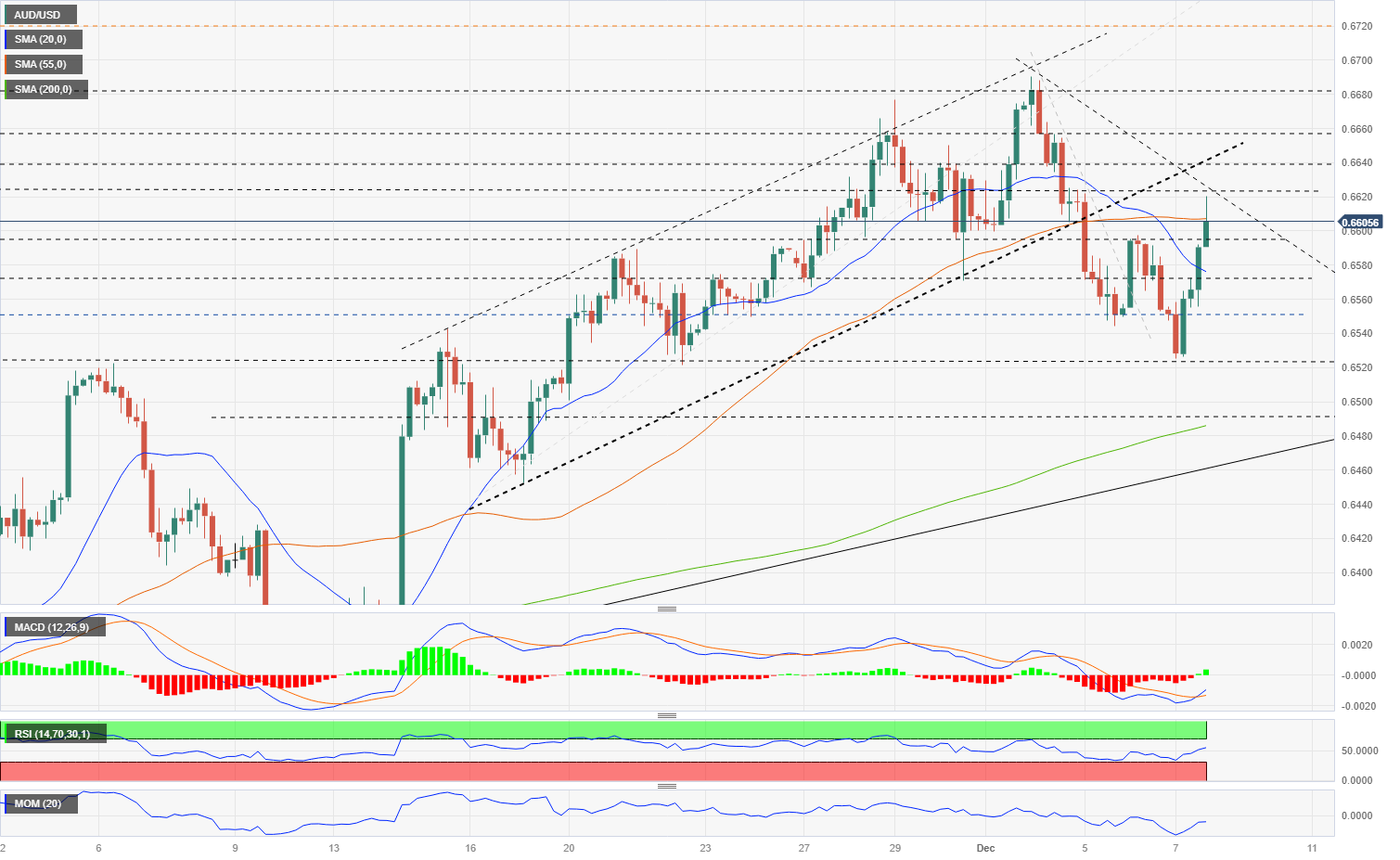

AUD/USD Current Price: 0.6606

- Improvement in risk appetite helped the rebound of AUD/USD.

- US Dollar loses momentum and retreats amid lower Treasury yields ahead of NFP.

- The pair stays above the key 20-day SMA, with further gains likely while above 0essential90.

The AUD/USD rebounded from the 20-day Simple Moving Average (SMA) and two-week lows at 0.6525, reaching levels above 0.6600. The sharp rebound took place amid an improvement in market sentiment and on the back of a weaker US Dollar.

Trade data from Australia showed a 0.4% increase in exports in October, with the annual rate improving from -11.9% to -14.3%; imports declined by 1.9%, with the annual rate at 2.4%. Chinese exports turned positive from a year ago for the first time since April, but imports were lower than a year ago, suggesting that weak domestic demand persists.

The US Dollar weakened on Thursday and drove the AUD/USD pair to the upside. A decline in US Treasury Yields weighed on the Greenback. The momentum for the Greenback also faded, affected by an improvement in risk sentiment.

Data from the US showed that Initial Jobless Claims rose to 220,000 in the week ending December 2, slightly below the expected 222,000, while Continuing Claims fell to 1.816 million. Despite the recovery, overall claims point to a softer labor market, like the ADP report indicated and is what market participants are expecting from Friday’s Nonfarm Payroll report. However, the impact from labor market data could be limited if it does not show major surprises. Markets see the Federal Reserve (Fed) not raising rates further and speculate about when it will start cutting. The numbers are unlikely to alter current expectations.

AUD/USD short-term technical outlook

The AUD/USD has remained above the 20-day Simple Moving Average (SMA) and is also above the 200-day SMA. It is still in negative for the week but has trimmed its losses. The Australian Dollar isn’t ready to resume its upside move, but the correction has weakened. The technical indicators on the daily chart are now more balanced.

On the 4-hour chart, the price is above the 20-SMA and above 0.6600. While it stays above this level, further gains seem likely. However, it would need to break above 0.6630 for a clearer outlook, opening the door for 0.6660. On the downside, a break below 0.6575 could lead to a test of 0.6545.

Support levels: 0.6595 0.6565 0.6525

Resistance levels: 0.6630 0.6660 0.6690

View Live Chart for the AUD/USD