- GBP/USD remained volatile, ending the week below 1.2700.

- Fed speakers will take centre stage amid a relatively data-light week ahead.

- Risks skew against the Pound Sterling from a short-term technical perspective.

The Pound Sterling (GBP) traded firmly against the US Dollar (USD) following a two-week sluggish momentum. Mid-week, GBP/USD buyers took back charge even as both the US Federal Reserve (Fed) and the Bank of England (BoE) pushed back against early interest rate cut expectations. However, the pair turned south on Friday following the release of the US Nonfarm Payrolls (NFP) report.

Pound Sterling staged an unsustained rebound

GBP/USD managed to hold its ground, having tested the weekly low near the 1.2600 region. The pair enjoyed two-way business but remained confined within a familiar range at around the 1.2700 level. The volatile trading around the pair could be attributed to a bunch of top-tier US economic data combined with the Fed and BoE policy announcements.

The market expectations surrounding the Fed interest rate outlook dominated the sentiment in the first half of the week. Data on Tuesday showed US JOLTS Job Openings unexpectedly increased in December and suggested that the labor market still remains resilient, squashing hopes of a March Fed rate cut.

The US Treasury bond yields came under the bus on Wednesday and smashed the US Dollar alongside, after the ADP Employment Change data came in below estimates at 107K and following the Treasury Department’s quarterly announcement that it would sell $121 billion in notes and bonds next week, up from $112 billion last quarter.

A relatively hawkish tone delivered by the Fed, following the conclusion of its two-day policy meeting on Wednesday, failed to offer any respite to the US Treasury bond yields while the US Dollar found support from the Fed’s dismissal of a March rate cut. The US central bank extended the pause and Fed Chair Jerome Powell said during the post-meeting press conference that “based on the meeting today, I don’t think likely we will have a rate cut in March.”

Amidst renewed US Dollar demand, the upside in the GBP/USD pair remained capped near 1.2750. The Pound Sterling failed to capitalize on the BoE’s hawkish rhetoric. Following its February policy meeting on Thursday, the UK central bank held the policy rate at 5.25% but said that inflation risks are skewed to the upside while lifting its 2025 inflation forecast. BoE Governor Andrew Bailey remained non-committal on what will be the Bank’s next interest rate move in the upcoming meetings. The voting pattern revealed a three-way split, with one member having voted in favor of a cut and two policymakers voting for a hike.

GBP/USD recovered from two-week lows of 1.2625 in the BoE aftermath, helped by a fresh sell-off in the US Treasury bond yields and the US Dollar after the US Labor Department data showed Initial Jobless Claims rose more than expected last week. The risk-on rally on Wall Street indices, thanks to the impressive tech results, also hit the safe-haven demand for the US Dollar.

The pair resumed its slide on Friday, following an impressive US Nonfarm Payrolls (NFP) report. The country reported 353K new job positions were added in January, much stronger than the 180K anticipated. The Unemployment Rate held at 3.7% vs an uptick to 3.8% expected, while Average Hourly Earnings rose 4.5% YoY, higher than expected. The US Dollar soared with the news, as it further cooled expectations of a March rate cut.

A data-light week ahead

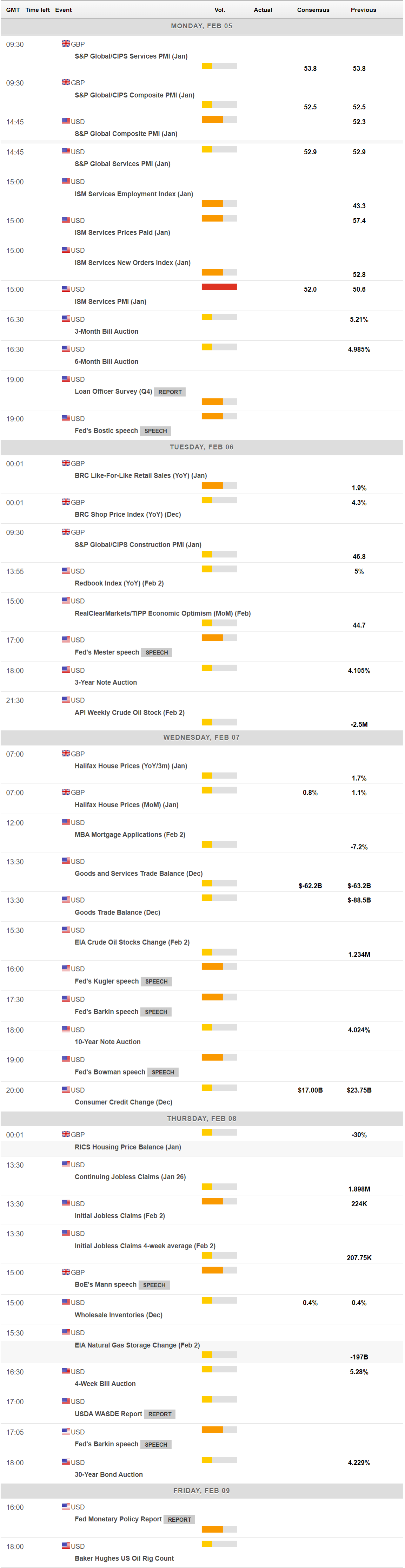

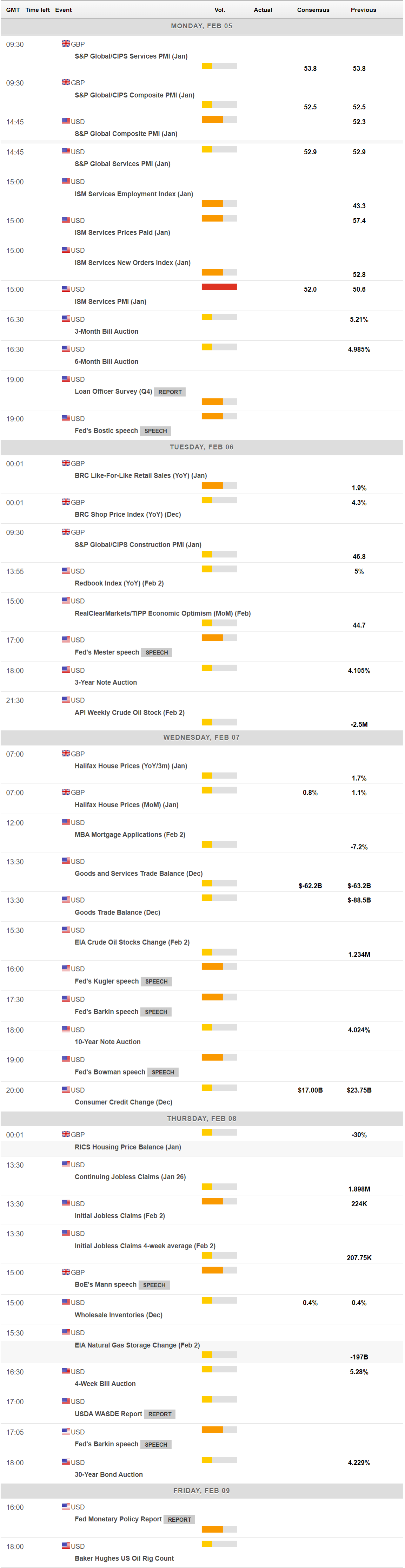

In the weed ahead, the Pound Sterling will take a breather after an action-packed week, full of key central banks’ decisions and top-tier US economic data.

There are no high-impact data releases from the United Kingdom. Therefore, the ISM Services PMI and Jobless Claims data from the United States will keep traders entertained.

Chinese inflation data will be closely scrutinized and could have a significant impact on risk sentiment and the value of the US Dollar, eventually affecting the GBP/USD pair.

Speeches from the Fed officials will hog the limelight following a slightly hawkish shift in the Fed’s policy stance.

GBP/USD: Technical Outlook

The short-term outlook for GBP/USD continues to point to a limited-range trading action so long as the price remains below the static resistance near 1.2830.

Acceptance above that level is needed to take on the 1.2900 round figure, above which a fresh uptrend will initiate toward the psychological barrier at 1.3000. Near term, the pair could find initial resistance at the 21-day Simple Moving Average (SMA) just above 1.2700.

The 14-day Relative Strength Index (RSI) indicator holds comfortably above the 50 level, suggesting that the upside potential remains intact in the major.

A sustained move below the weekly low at 1.2625 could trigger a fresh downtrend toward the ascending 200-day SMA at 1.2560. Finally, the 100-day SMA at 1.2475 will be the line in the sand for buyers.