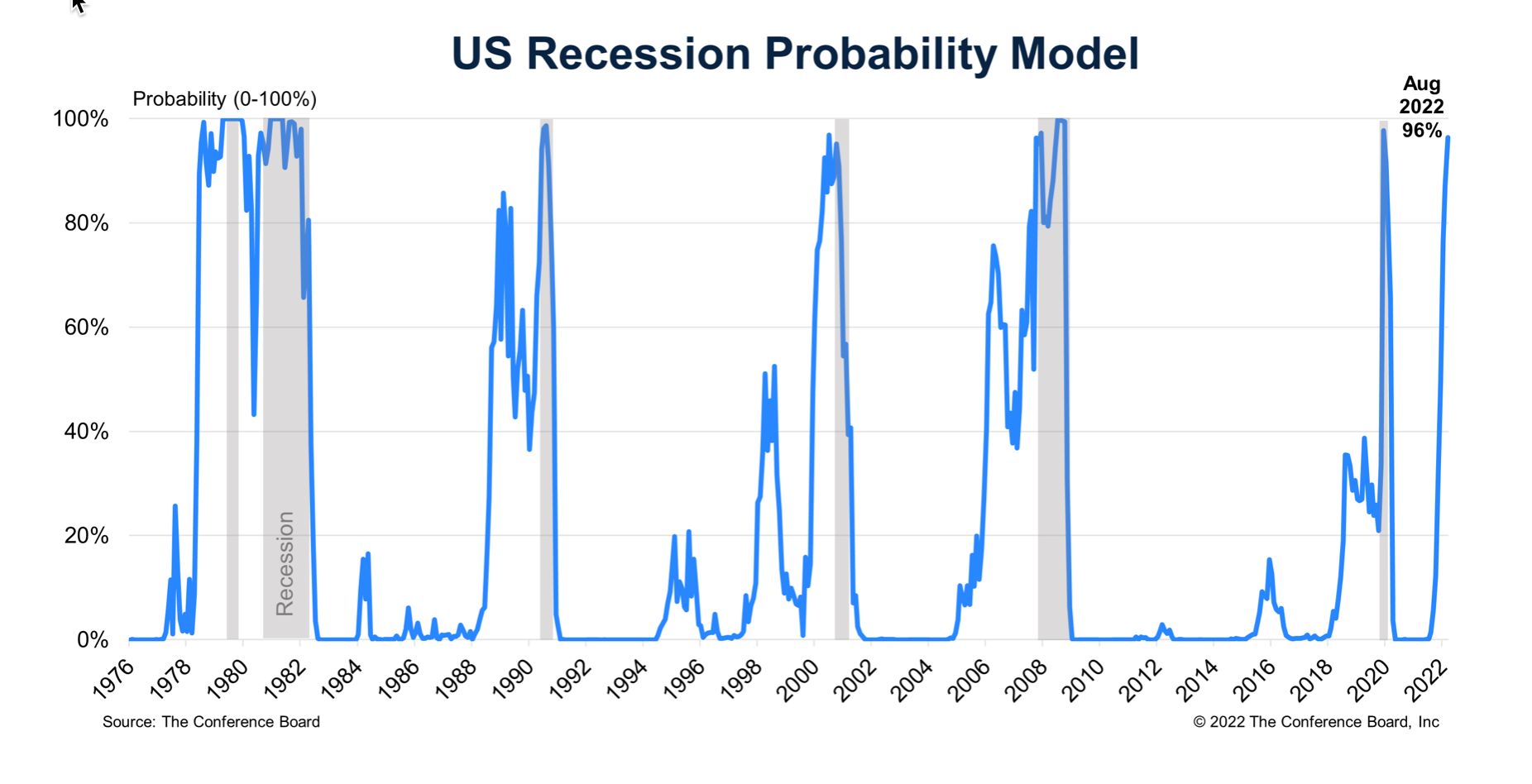

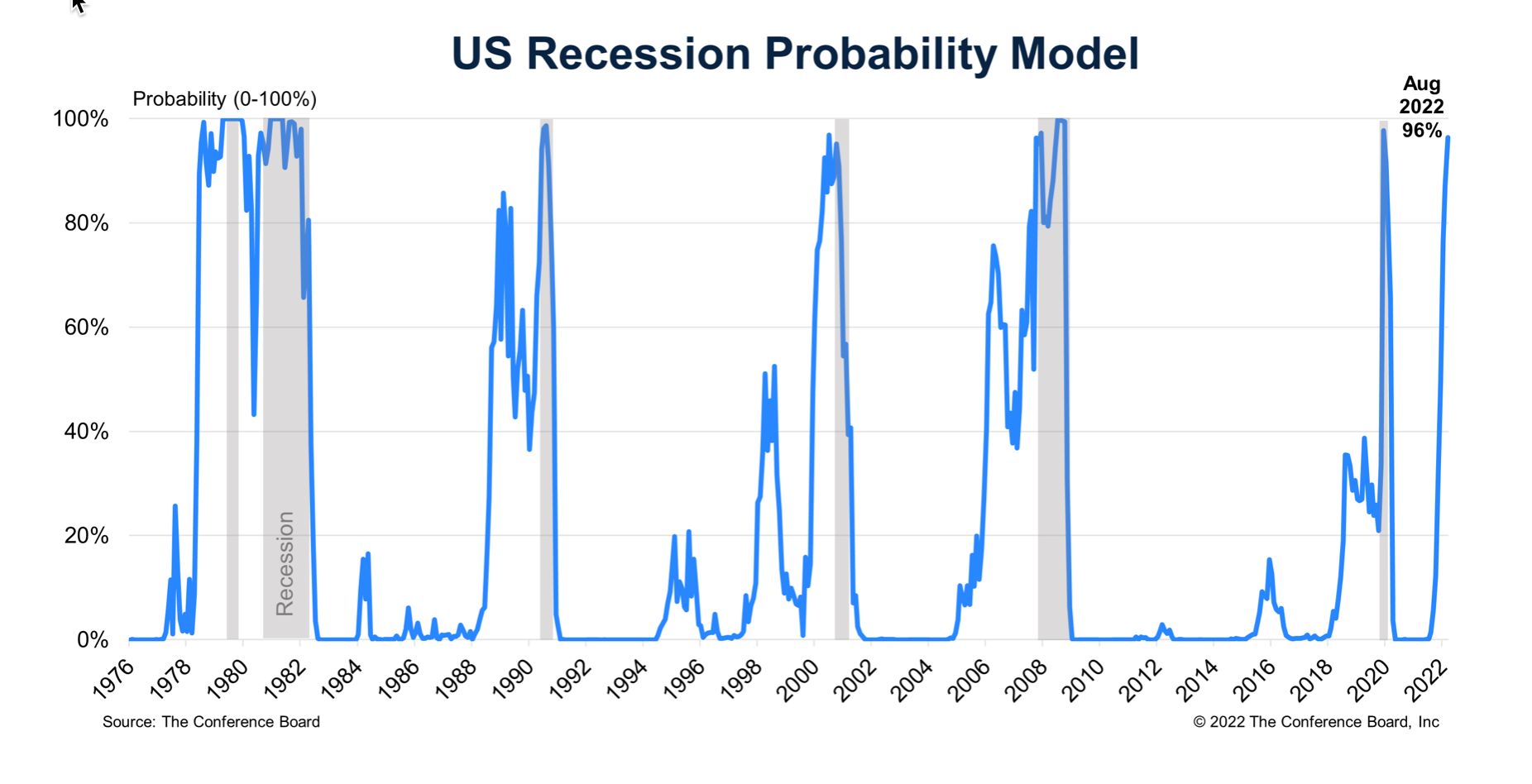

US stocks tanked at the end of last week, after the stronger than expected US NFP report for September reinforced the Federal Reserve’s hike-and-hold path for interest rates, which are pushing up recession risks for the US and the global economy. The Conference Board now predicts a 96% chance of a recession in the US within the next 12 months. While US GDP has already registered a technical recession, The Conference Board’s measure is more accurate. Right now, it predicts that the US economy will experience a recession in Q4 2022 and Q1 2023. The question now is, when will the US economy climb out of recession? We will be watching the The Conference Board recession probability model closely, as it is also good at predicting the end of recessions when it falls rapidly, usually one or two months before the economy starts to pick up. Thus, watch chart 1 closely in the coming months to determine the turning point for the US economy.

Economic and corporate data this week will be important in helping us to figure out just how bad this recession will be. US CPI on Tuesday and the start of Q3 earnings season in the US are worth watching closely.

Dollar headwinds start to cause problems

Looking at earnings season first, analysts are expecting a feeble set of results, with $34bn slashed from earnings estimates over the last 3 months. Analysts now expect S&P 500 companies to post earnings per share growth of 2.6% in the three months to September, at the start of July analysts had been looking for a bounce back for earnings, with 10% growth expected. Thus, this is the largest cut to earnings since the pandemic. A perfect storm of higher interest rates, weak consumer sentiment and stubbornly high inflation have darkened the outlook for this earnings season. This has been reflected in stock market performance in recent months, with stocks tanking again at the end of last week. Earnings season is likely to be closely watched and could trigger bouts of volatility.

The FX problem for US blue chips

FactSet, the data gathering company, has noted that 50% of companies that have already reported Q3 earnings, about 4% of companies on the S&P 500, have cited unfavourable foreign exchange rates as having a negative impact on their earnings. This is a far higher percentage than last year at the same point in the earnings season and concerns about the strong dollar have been steadily growing in the last four quarters. Of all the factors analysed by FactSet so far in Q3 earnings season, only higher interest rates have triggered a larger quarter-over-quarter increase in negative citations so far. Given that the dollar has been rising strongly, and that 40% of S&P 500 companies have significant overseas earnings exposure, it is no wonder that FX rates are a concern. This will be worth watching over the rest of earnings season, and we expect to see more companies complain about the strong dollar, especially after momentum in the US dollar has ramped up significantly in recent months.

A bright side for Q3 earnings season?

While there are notable headwinds for the S&P 500 and global blue chips as they report Q3 earnings, it is possible that we could see some upside surprises. Despite analysts revising down their estimates for Q3 EPS growth, companies have been more positive in their earnings guidance for Q3 relative to recent quarters. What does this mean? Of the 106 companies that have issued forward guidance for Q3, 65 have issued negative guidance and 41 have issued positive guidance. This is above both the 5- and 10-year averages. Companies in the real estate, industrials and consumer discretionary sectors have recorded the largest increases in positive EPS guidance for Q3. In terms of the market reaction, FactSet have found that the market is punishing S&P 500 companies who issue negative guidance by a bigger margin than average, while they are rewarding companies that issue positive guidance, with companies’ stock prices rising 3.1% in the days after the positive guidance was issued. The market is extremely sensitive right now, so it will be watching out for guidance for Q4 earnings and beyond. However, if companies surprise on the upside during Q3 earnings season, then we may see a bounce back in stock prices in the coming weeks.

US economy: Sticky inflation back at 1990 levels

The market is laser focussed on Federal Reserve monetary policy right now and US stock markets are mostly lower on Monday, with volatility having jumped at the start of the week. A key theme for markets right now, is the prospect of dovish pivot from the Fed. Hopes were dashed on Friday, when the US unemployment rate unexpectedly fell. Fed speakers are also pushing back against concerns about stress in financial markets, which is feeding a theme that the Fed will keep raising interest rates until it breaks something. This is keeping markets on their guard especially as we wait for the September US CPI report released on Thursday. The market is expecting monthly headline inflation to rise by 0.2%, but for the annual headline CPI rate to fall to 8.1% from 8.3%. However, when oil prices are volatile, Opec have cut production and Brent crude oil is back above $97 per barrel, does anyone care about a decline in headline inflation?

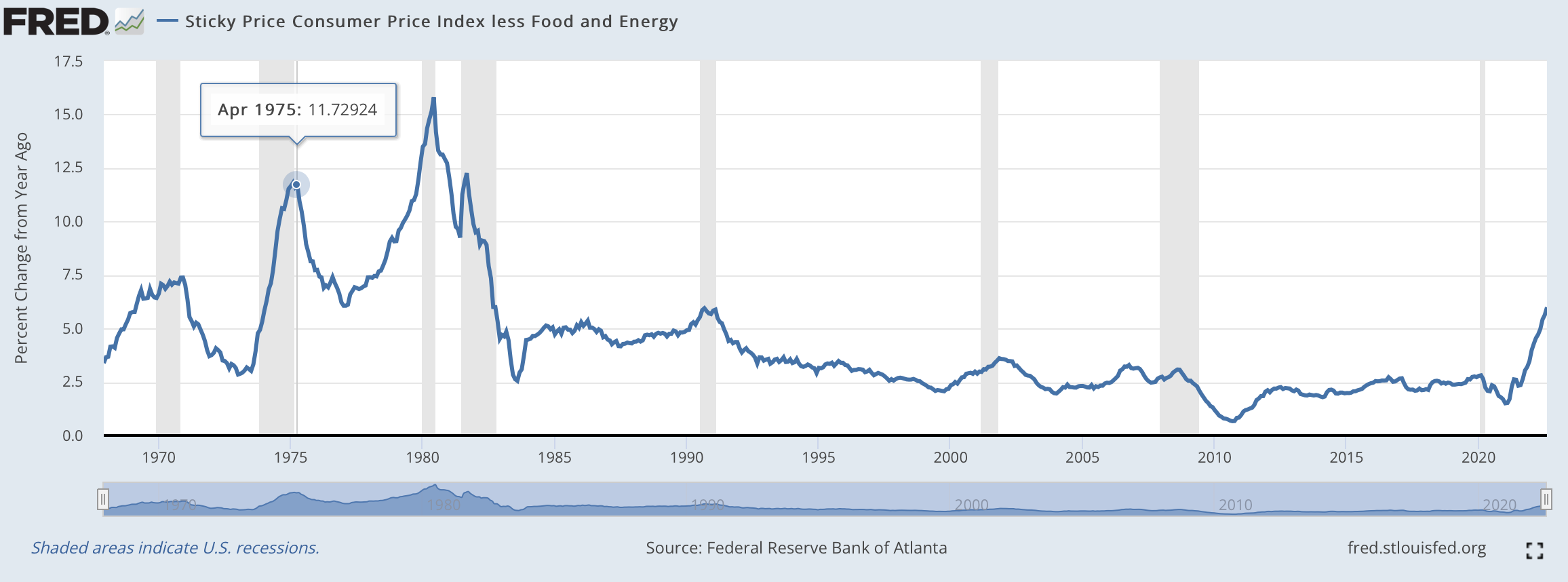

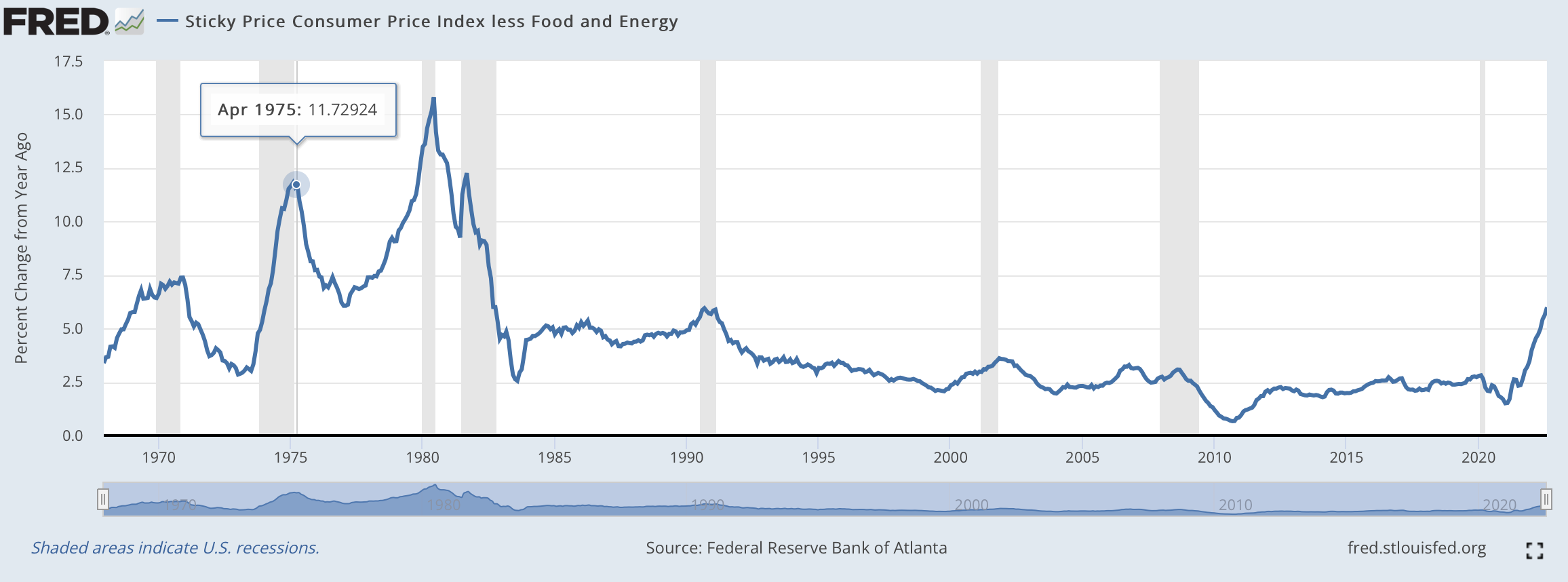

Instead, we believe that the focus will all be on the core rate of CPI, which is expected to record a 0.5% monthly increase, with the annual rate expected to rise to 6.5% from 6.3%, on the back of rising shelter costs. The surge in mortgage rates at the same time as rents are high in the US and around the world means that shelter costs could be sticky and take some time to come down. Thus, for those looking to buy risky assets on the back of a Fed pivot, they could be bitterly disappointed. The St Louis Fed’s index of sticky price inflation in the US is currently at 5.99%, and is at its highest level since 1990, as you can see in the chart below. Back then the US fell into a recession, and sticky inflation did not fall until the economy emerged from its contraction. We expect the same to happen this time. An increase in the rate of core CPI for last month could also lead to expectations that the Fed’s terminal rate will have to be higher than currently expected. Right now, the market expects the peak in the Fed’s hiking cycle to be 4.50-4.75%, however, if inflation persists then the peak in the Fed’s hiking cycle may have to be closer to the core CPI rate, above 6%. Thus, the Fed’s pivot seems a long way off, which supports higher bond yields, weaker stocks, and a stronger dollar.