Outlook: Pivot talk is officially dead. Formerly dovish Minneapolis Fed Kashkari said the Fed is “quite a ways away” from pausing its rate-hike cycle. Chicago’s Evans said the rate will probably reach 4.5-4.75% by next spring. New member Cook said more hikes are needed to tame “stubbornly high inflation.” We get three more today (Williams, Kashkari and Bostic). Separately, the IMF meets next week and is sure to offer more unsolicited and unwelcome advice.

The dollar is again too strong, running above 145 against the yen for the first time since 1998. This is a function of US yields rising again while Japan holds the line artificially. Everybody has rising yields. See the chart. The Swiss 10-year is over 1.3% for the first time in 11 years.

Payrolls today will be the usual misery for traders. The Bloomberg version is a gain of 255,000 jobs (Reuters has 250,000), and that’s with the government shedding, so all private sector. As usual, the FX market will react to the actual vs. the expected, and if it’s a big gain, like 350,000, it’s conceivable the 100-point hike can come back again, although you’d think the traders would have learned their lesson by now.

If it’s a far smaller number, like 100,000, traders will pare back rate expectations to (say) 50 bp and exit fat dollar long positions. The problem with trading the news and especially this news is that crazy people and algos will exaggerate the moves and ram prices right through your stops and targets. It’s a fool’s game.

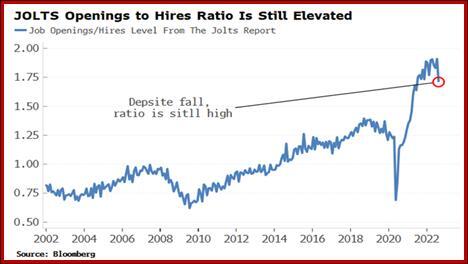

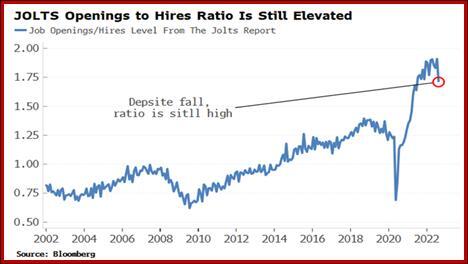

While today’s data may not be meaningful, actually meaningful numbers are lining up behind the curtain. See the chart from Bloomberg and eminently sane commentary: ”…. multiple leading indicators show us that the cycle is peaking and the jobs market will soon start to slow, although we are unlikely to see this clearly in the data for a few months yet.

“Until then, the Fed is laser-focused on inflation. And while an unexpectedly very weak set of employment data would prompt the market to increase the size (and perhaps move back the start of) the Fed pivot, a single, notoriously noisy data point will not be enough for the Fed to be confident the inflation wind has changed. Payrolls are likely to be hotly anticipated for many more months to come.”

Today is as slow as molasses until payrolls comes out, and even after that bomb, there is little else going on except chit-chat about Elon Musk and what to wear in the Columbus Day parade next Monday. Monday is a national holiday in the US and government offices are closed, but not every bank shuts down and we usually get some trading. FX will be slow and thin because the US bond market is closed, but the stock market will be open. Go figure. The CBOE is open but the CME floor is closed for FX–but Globex is open, so we while we don’t get an official open and close until the next day, we still get some action. It’s very messy. We will publish all reports as usual but not happily because the prices will be sub-par.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!