After July’s central bank meeting, the RBNZ hinted at concerns about slowing growth. Even heading into July’s meeting the Bank of New Zealand head of research warned that the latest ANZ Bank survey of business opinion was ’littered with indicators that fit with our view that the economy is headed into recession. There are now more reasons for the RBNZ to take a dovish tilt next week on August 17.

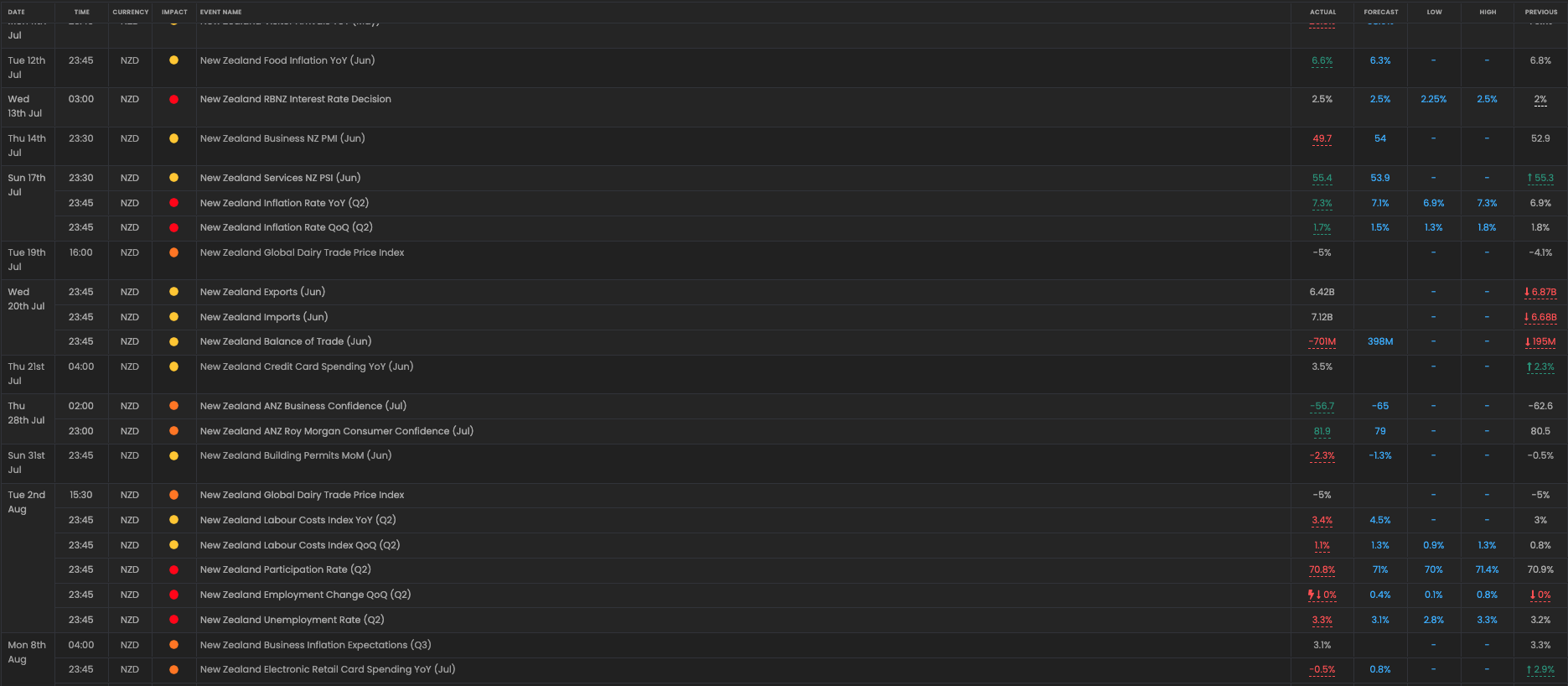

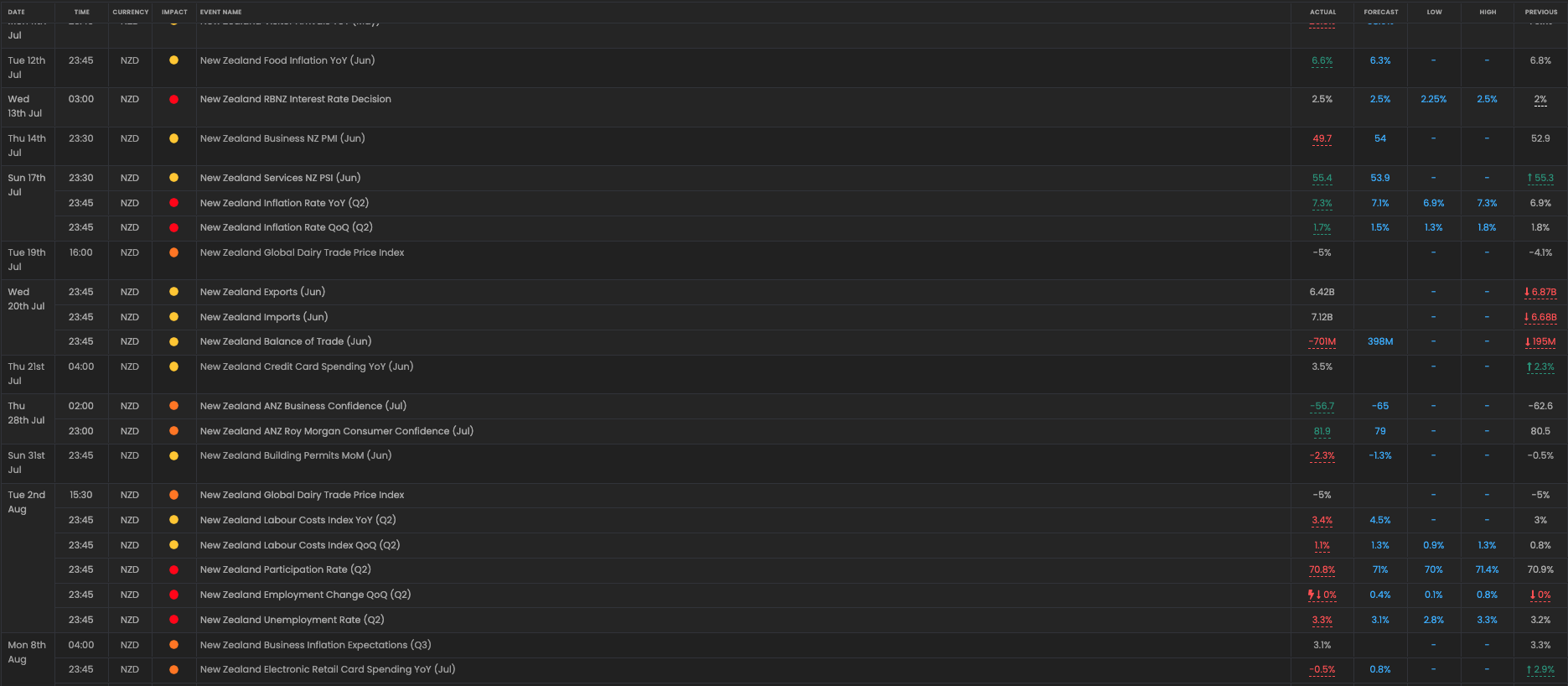

Here is some of the recent data from New Zealand:

New Zealand business PMI

This missed expectations and fell into the contractionary territory of 49.7 down from the forecast reading of 54. This supported the negative outlook from BNZ’s head of research after the survey of business opinion.

New Zealand labour data

The unemployment rate was up to the highest estimate at 3.3%. The QoQ change was down to 0% from 0.4% expected and the participation rate fell too at 70.8% vs 71% expected.

New Zealand electronic card spending

The New Zealand consumer was spending less with retail card spending down y/y in July to -0.5% vs 0.8% expected and down from 2.9% prior.

Goldman Sachs sees recession risk for New Zealand

Goldman’s model sees a 30-35% chance of a New Zealand recession with a sharp US downturn increasing that to 50-60%. So, although the RBNZ is expected to hike by 50 bps on Wednesday, 17th August, the RBNZ seems likely to mention the slowing growth metrics. One ray of hope has come from the last ANZ business confidence print of -56.7, which was better than the -65 expected. However, the report by itself may not be enough to allow the RBNZ to ignore slowing growth data.

NZD data

The best opportunities will likely come from this situation:

1. If the RBNZ only hikes by 25 bps and stresses slowing growth concerns then look for the following likely reactions:

-

NZD selling

-

AUDNZD buying

2. If the RBNZ hikes by 50bps (as expected), but stresses slowing growth and rising recession risks then expect the following likely reactions:

-

NZD selling

-

AUDNZD buying

The main risk to this outlook would be an unexpected reaction to the announcement. Also, be aware that sentiment can change very quickly, so always manage risk carefully.

Learn more about HYCM