- US BLS will release the September CPI figures on October 13.

- Markets expect core inflation to rise 0.5% on a monthly basis in September.

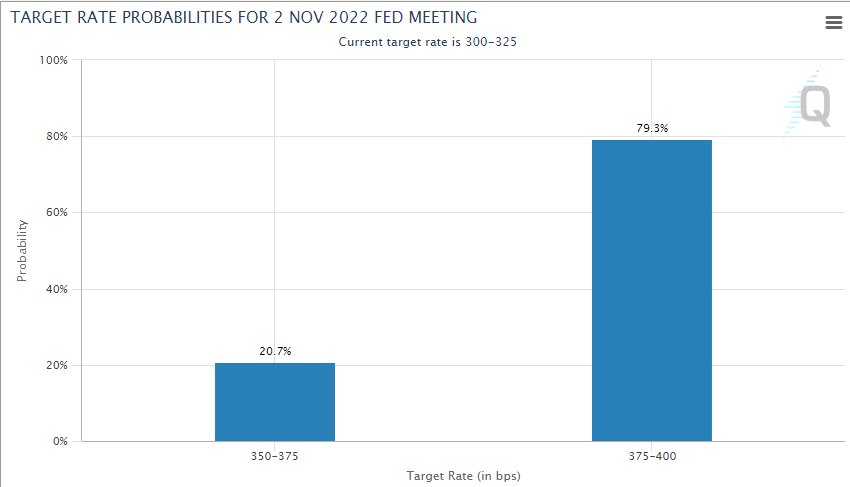

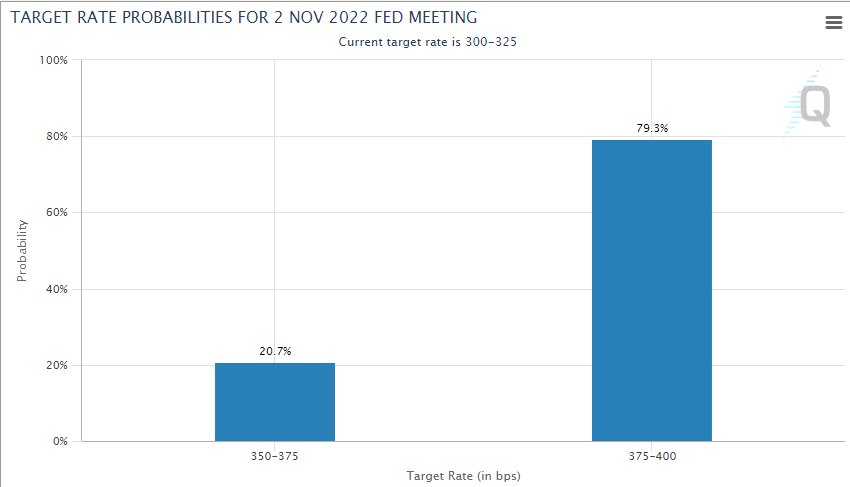

- Markets are pricing in an 80% probability of a 75 basis points Fed rate hike next month.

The US Bureau of Labor Statistics will release the Consumer Price Index (CPI) figures for September on Thursday, October 13. Although the Fed uses the Personal Consumption Expenditures (PCE) Price Index data as its preferred gauge of inflation, market participants are likely to react more significantly to the CPI data simply because it's published two weeks before the PCE. Additionally, the CPI is widely seen as a better measure of what consumers observe with regard to changes in prices.

Investors expect the headline annual CPI to decline to 8.1% from 8.3% in August. The Core CPI, which excludes volatile food and energy prices, is seen edging higher to 6.5% from 6.3% in the same period. On a monthly basis, the CPI and the Core CPI are expected to arrive at 0.5% and 0.2%, respectively. Since the monthly figures are not distorted by the base effects, they are likely to paint a more accurate picture of core inflation.

Previous Core CPI (MoM) releases

It's worth noting that the September jobs report showed that Nonfarm Payrolls rose at a stronger pace than expected in September and that the Unemployment Rate declined to 3.5% from 3.7%, allowing the Fed to stay focused on battling inflation.

Market implications

When the data for August showed that the Core CPI rose by 0.6%, compared to the market expectation of 0.3%, the probability of a 75 basis points rate hike in September rose sharply and the US Dollar Index (DXY) gained 1.5% on a daily basis.

Currently, the CME Group FedWatch Tool shows that markets are pricing in a nearly-80% probability of one more 75 bps rate hike in November. Hence, the dollar's potential gains on a stronger-than-expected monthly core CPI reading are likely to remain limited. Also, following August's surprise, investors seem to have already prepared for a strong inflation report by forecasting a 0.6% monthly increase. At this point, only a monthly increase of between 0.8% and 1% in Core CPI could be significant enough for market participants to start considering the possibility of a 100 bps rate hike in November and trigger a fresh rally in the US Dollar Index.

Source: CME Group

On the other hand, a soft inflation report with the monthly Core CPI coming in much lower than analysts' estimate, between 0.2% and 0.4%, could open the door for a risk rally. In that case, Wall Street's main indexes could post impressive gains and the USD is likely to suffer heavy losses against its major rivals in the short term.

Nevertheless, unless there is a negative Core CPI print, investors are unlikely to scale back 75 bps hike bets, helping the dollar hold its ground after the initial reaction. FOMC policymakers made it clear that they will not overreact to one-off inflation data and that they will stay on the tightening path until they are convinced inflation is falling steadily.

Finally, in case CPI figures come in largely in line with analysts' projections, the DXY is likely to return to pre-release levels once the dust settles following the knee-jerk market reaction.