WTI Oil

The WTI oil price heads lower for the second straight day, as sentiment soured on unexpected hawkish stance of three major central banks, though optimism on hopes about China’s demand recovery and fears on supply disruptions, remains alive.

The WTI contract, despite losses in past two days, is on track for bullish weekly close that may delay larger bears, which face headwinds from psychological $70 support, where the action was repeatedly rejected.

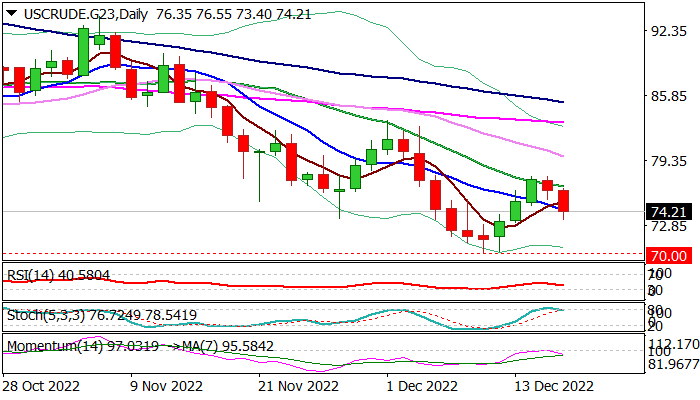

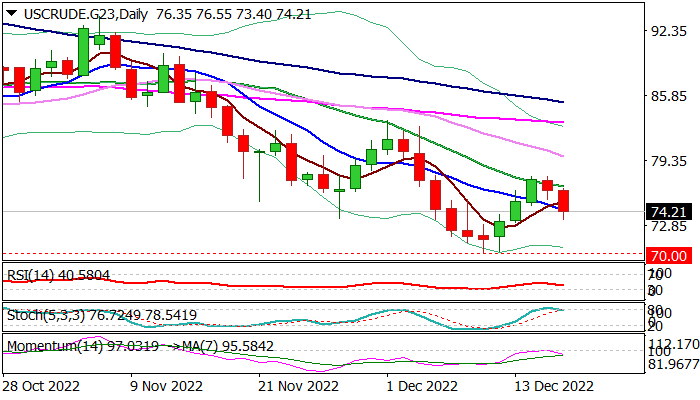

Signals from daily chart are in favor of further weakness as negative momentum is strengthening and MA’s are in bearish setup, while stochastic emerges from overbought territory. This suggests that the downside remains at increased risk, especially if Friday’s action closes below 10 DMA ($74.39) which would open way for renewed attack at pivotal $70 zone. Firm break below $70 would risk fresh acceleration and expose targets at $68.50 (50% retracement of $6.52/$130.48) and $65.05 (200WMA) in extension.

Near term bias is expected to remain with bears while the action stays below the double-top at $77.73/79 (Dec 14,15) and only firm break here would ease downside pressure and allow for stronger bounce.

Res: 75.97; 76.55; 77.79; 79.79.

Sup: 73.03; 71.91; 70.00; 68.50.